From being a manufacturer and trading company, we aim to become a true manufacturing company.

To Shareholders

I will now report on the performance of the Naigai TEC Group for the first half of the 64th fiscal year (April 1, 2024 to September 30, 2024).

During the first half of the current consolidated fiscal year, the Japanese economy continued to recover gradually on the back of improvements in employment and income conditions, despite concerns about a downturn due to factors such as the sharp rise in raw material prices and energy costs amid unstable conditions outside Japan and the prolonged depreciation of the yen.

In the semiconductor and semiconductor production equipment markets in which the Naigai TEC Group operates, there has been a recovery trend driven by increasing demand for semiconductors related to the spread of AI, for example, with regard to data centers. If we look at the future, the semiconductor and semiconductor production equipment markets are expected to grow in the medium to long term for a variety of applications, including digital transformation (DX) and data centers. Furthermore, from the perspective of economic security, plans are being advanced for constructing new and expanding existing semiconductor factories around the world.

In this environment, the Group steadily implemented the measures set forth in MIRAI 2026, its three-year medium-term management plan that began in the current consolidated fiscal year. It worked to strengthen its development capabilities by actively recruiting engineering personnel with knowledge of semiconductor production equipment, vacuum equipment and the like in order to further expand its business. In addition, it has made preparations to acquire a new factory site (in Oshu City, in Japan’s Iwate Prefecture) to strengthen our development and production capabilities.

As a result, the Naigai TEC Group posted a decrease in sales and income for the first half of the current consolidated fiscal year due to the continuing impact of inventory adjustments, despite the ongoing market recovery.

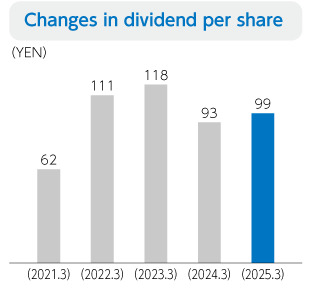

For the current consolidated fiscal year, we expect a recovery in earnings beginning in the second half of the year as inventory adjustment progresses, and as announced on May 15, 2024, we expect to see an increase in sales and income, with sales of 43.8 billion yen (up 12.3% year-on-year), operating income of 1.54 billion yen (up 26.4% year-on-year), and profit attributable to owners of parent of 1.03 billion yen (up 21.4% year-on-year). Based on the earnings forecast, we also plan to increase our dividend forecast to 99 yen per share.

We consider returning profits to our shareholders to be one of our most important management policies, and we will continue to strive to further increase our corporate value and meet their expectations. We look forward to receiving the continued support and guidance of our shareholders.